Owning property in a place we have lovingly christened The Lowcountry is clearly going to involve a conversation about tropical events.

Most places around here are completely fine. Others experience street flooding.

Some unfortunate spots have seen stormwater intrude into homes.

The point is: it’s not everywhere. Most of the built environment in the Lowcountry was designed for tropical events – Charleston is wonderful, and it’s also subtropical.

The flooding thing – it’s manageable and often overhyped. Just be smart about it, and work with a real estate broker that knows the landscape.

If I could post a granular, definitive guide for “go here, but avoid that” – maybe I would, but there are just too many factors to consider.

This is where expertise earns the extra mile I suppose.

Prior to the National Flood Insurance Program (NFIP) there were virtually zero insurance providers that wrote policies for flood events. For better or worse, homes in the United States could be covered for fires, windstorm damage, and burglaries, while absolutely unprotected for weather-based flooding events.

The NFIP was established explicitly because there were effectively no private market options for purchasing flood insurance in the United States. The program created a fund subsidized by the federal government that would buffer claims for insurance providers, essentially enabling them to write a policy knowing that their losses would be effectively capped. To determine the policy rates, the Program tasks FEMA to work with local governments in assessing the flood risk levels in their communities – the primary gears in this machine are flood zone maps along with elevation certificates for individual properties.

But the Program isn’t simply a subsidization of insurance – the flip side is that it also governs the way new homes are built, so that flood damage claims could be minimized for future U.S. housing stock. Any home built today must be elevated above the base flood elevation (BFE) determined in the flood zone maps.

What is Flood Insurance

Any sensible homeowner will purchase what is commonly known as a homeowners insurance policy that covers any number of losses that could occur, which are understandably required by lenders for homeowners with a mortgage. These policies provide coverage for all sorts of calamities from fires and windstorm damage, to plumbing backups and burglaries, even liability and medical coverage for when a guest is injured on the property. However there is one major omission from virtually every homeowners policy: flooding.

The specification of flood insurance comes down to what defines a flood: essentially, a rising water event that affects more than one property.

By way of examples: if a pipe bursts in your house, or if a storm busts a window and drives in rain, the incurring water damage would be in the realm of the homeowners insurance policy.

However, if an event occurs with rising water that affects multiple properties – typically a major weather event – a homeowners policy would not cover those damages, which can be substantial. This is an event that is only covered by a separate flood insurance policy.

Homes that reside in a FEMA-designated flood zone are eligible – and often required – to purchase flood insurance on the property. New homes may be constructed in a flood zone, however must abide by strict building requirements to minimize damage from a flood event – often by elevating the home above a certain level, the base flood elevation (BFE).

Assessing Flood Risk

Floodplains are defined by FEMA as areas that have a 1% chance to flood during a given year, often termed a “100-year” flood zone. It’s all statistics whose accuracy is limited to available data, and there are no guarantees.

That 1% flood probability can be at or above the actual land height, and base flood elevation is the term used to describe the height above the land that is likely to experience flooding, expressed in reference to the mean sea level (AE10 indicates a 1% flood risk to 10 feet above sea level on that property).

Types of Flood Zones

X

Low Risk: these are areas outside the 1% likelihood zone. Most of the Charleston area is an X flood zone. In fact most of the United States is designated as an X flood zone.

A common misconception among many in real estate circles is that X means “not in a flood zone” – this is absolutely not true. X simply means that the risk is below the 1% mark.

While lenders typically do not require a homeowner in an X flood zone to carry a flood insurance policy, in some cases it still may be advisable to acquire one anyway.

Most homes in the Charleston area reside on ground high enough to be reasonably assured they would never flood, though an experienced eye can suspect that major storm events can lead to localized flooding in some neighborhoods.

We consult with insurance providers during the purchase of homes in X flood zones to assess the risk prior to purchase so we can make an informed decision regarding any risks of water damage.

AE

Moderate Risk: these are areas that are deemed likely to flood up to a specified elevation at least once every 100 years. In Charleston these are typically lower lying areas near marshes and rivers, and is by far the most common designation other than X.

The “E” in the AE indicates that a base flood elevation is known, which provides guidance to insurance providers to set rates and to builders for how elevated a new construction home must be.

A home residing in an AE10 zone would have a flood insurance policy based on how high the first floor of the home is above the 10 foot mark above sea level.

In Charleston a new home built in an AE10 zone varies by its ground level: on the beach just above sea level, the home would probably be elevated by 8-10 feet or more, often designed with parking and storage underneath.

But farther inland a new home built in an AE10 zone may be elevated by just a few steps if at all.

An older home – of which there are obviously very many in Historic Charleston – sometimes don’t meet the requirements set in the 1970s for new construction.

While many historic homes were smartly elevated by design, quite a few were not.

These homes can still acquire flood insurance, though for every inch that the first floor is below the base flood elevation, the higher the flood insurance premiums will be.

In that AE10 zone, an historic or midcentury home in Charleston may be in a low lying area but only elevated by a foot or two if at all, with a flood elevation certificate indicating the first floor is less than 10 feet above sea level. Its flood insurance rates would be higher – though usually manageable – and a smart homebuyer would be advised to take caution in the purchase, and also to take steps during ownership to prevent potential water damage.

A home that is much lower than the AE10 mark would see flood insurance rates that would likely be unpalatable, unless definitive actions have or will be taken to prevent damage and reduce insurance costs – up to and including raising the home onto a new, higher foundation.

VE

Higher Risk with potential of storm surge: these are areas that are subject not only to rising water levels, but also to impact from waves during a major tropical storm.

In Charleston these are waterfront homes, or very close to a major body of water.

Oceanfront homes are designed and constructed to withstand the full brunt of an intense hurricane, far beyond what a typical home would experience elsewhere.

Such storms are relatively uncommon in the Charleston area, however tough lessons from the past can be seen in the beachfront homes we see today.

Before the National Flood Insurance Program, homes on the beaches of Charleston were typically modest affairs – since virtually no insurance underwriter would write a flood policy for these properties, the homes were built rather simply.

I have memories of those shabby cinderblock beach houses, leaky and musty, beach sand strewn across the unfinished pine flooring.

Fond memories of those austere beachfront homes from decades past are often all this left of them: hundreds were literally swept away during Hurricane Hugo in 1989; others were devastated beyond repair. They have since been replaced with the sturdy elevated structures we see today, often luxurious because they are now insurable, albeit at substantial cost.

When buying a home in a VE zone, we work with insurance providers to estimate the real risk and also acquire accurate premium rates before completing the purchase. Many of these homes are intended as beachfront vacation rentals, and the insurance rates are considered operating costs by the owner.

Flood Zone Maps

To provide guidance for homeowners and insurance providers, FEMA works with local governments in Charleston to establish maps of flood risk, based on data from past flood events and predictive analysis.

The maps are GIS overlays of the Charleston area indicating the boundaries of X/AE/VE zones.

When working with homebuyers, a critical segment of our process is to examine these maps to assess the real risk of flood, and also to acquire flood insurance rates from insurance providers.

Flood zone maps are updated every few years to provide greater accuracy, however a hindrance in the 2004 Charleston County maps is that they were based primarily on storm surge data from a theoretical Category 3 hurricane – certainly an understandable concern, however they did not adequately address potential flooding from more regular events like heavy rainfall during a high tide. The flood zone maps for Charleston County are set to be updated with more broadly expansive data in 2021, expected to result in changes of designation for many areas.

Update 2021: the new flood zone maps for Charleston County are official – here is the full article:

New Flood Zone Maps

Before & After

How to Acquire Flood Insurance

Once the flood zone of a property is known, we then seek guidance from insurance providers. Homebuyers in AE/VE that are using a mortgage to purchase a home will almost certainly be required to carry a flood insurance policy, even if the home’s first floor is well above the base flood elevation (BFE). Those purchasing without a mortgage in AE/VE are advised acquire a flood policy as well.

Homes that are minimal risk in AE – that is, elevated well above the BFE – may see rates as low as $500/year. Older homes at or below BFE may see rates double, even triple that, or more. Sometimes the risks and costs are acceptable, sometimes they are not.

Homeowners in an X flood zone may also purchase flood insurance, often for very reasonable rates.

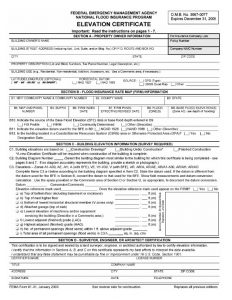

While the FEMA flood zone maps indicate the BFE of an area, they must be paired with an assessment of the home itself – that is, how high the first floor is above the BFE. The instrument that insurance companies use is the Flood Elevation Certificate – an official document from a licensed surveyor indicating the exact height of the structure.

FEMA Policies

Most flood insurance policies – and indeed for a long time the only policies – are underwritten directly by FEMA to buffer insurance losses and keep premiums affordable. These rates are standardized based on BFE and elevation certificates; older homes without an elevation certificate can also qualify for a pre-FIRM rate, though often it’s worth the expense to acquire an elevation certificate to potentially obtain a lower rate.

FEMA policies cover flood damage to the building and its components, capped at $250,000 – while most homes are valued above this amount, in real terms flooding rarely causes damage above the first floor of the home.

Contents and personal belongings of the home are also covered, capped at $100,000.

Private Market Policies

Over time the NFIP provided some stability to flood insurance markets, and insurance providers began to offer their own non-FEMA policies. Owners of some higher valued homes may wish to purchase coverage above limits of a FEMA policy, and can now purchase supplemental flood insurance from a number of providers in addition to or in place of a FEMA policy.

In recent years we have begun to see some of these private market policies with rates that are competitive or even better than FEMA policies – so work with us to shop around.

– Recommendations –

Flood Insurance Providers in Charleston

We have worked with these providers and are happy to recommend them based on previous experiences.

I only recommend working with local brokers that know the Lowcountry as well as I do.

To discuss in more detail, feel free to “Ask Bryan” in the link below.

Buying a home in Charleston?

Let’s talk about flood insurance: